Today, it would be difficult to picture this world existing without chatbots. If earlier such an invention seemed like an extraordinary and even fancy idea, now it is in demand in many industries, including banking and financial services. The introduction of AI in Fintech has completely changed the way in which companies communicate with their customers, providing them with 24/7 support and a more personalized touch. It is easy to see that this trend has been evolving with traditionally human employees being replaced by their artificial analogs – with more and more people interacting with them instead.

The impact of chatbots in the banking sector is undeniable. By 2020, banks were saving $0.50 per chatbot interaction. A well-designed chatbot system can handle a staggering 80% of simple user queries without human intervention. And when it comes to more complex customer interactions, the response rate can soar as high as 90%. Everyone wins with AI chatbots: customers appreciate the instant support, employees enjoy lighter workloads, and businesses save money while boosting efficiency.

What is a Banking Chatbot?

Let us start with the fact that chatbots are not something new. We all know them and use them on a near daily basis. However, when it comes to the industry of finances, you may be wondering: What are chatbots in banking? To provide exceptional levels of service while transforming the industry, most businesses are using AI to automate their operations. The banking chatbots are nothing but intelligent digital assistants that, based on artificial intelligence and natural language processing, perform human-like conversation with the customers. They can understand and respond to customer queries and requests as if you were chatting with a real person.

One of the most striking peculiarities of chatbots in the banking sector and any other is that they can be integrated with the existing systems and databases. This means that the chatbot application can “see” the required customer data, bank accounts, or other information to provide a relevant, personal answer. Unlike traditional customer service channels, bots are available around the clock, ensuring customers can get the help they need, whenever they need it, without being bound by business hours or staffing constraints.

It should also be noted that the chatbots do not stick to the strict human-created scripts. Also, they are not just simple response systems. They are highly sophisticated virtual assistants that understand the context, consumers’ intent, and are capable of conducting natural conversations.

Banking AI chatbots are a game-changing technology that financial institutions should definitely consider if they haven’t already. Thus, later in the paper, we will review the motives and incentives that prove why banks must have chatbots if they want to succeed in the industry.

Benefits of AI Banking Chatbots for Your Business

Although the decision to adopt this pioneering technology may seem daunting at first glance, the revolutionary advantages it brings to the table are worth the hassle. Here are a few of the remarkable benefits of chatbots in banking:

Objectivity

Chatbots do not have emotions or personal biases and can provide bank customers with objective and unbiased financial advice or information. This trait can be especially helpful in the case of investment advice, loan approval, or financial planning, where emotional reasoning can lead to suboptimal outcomes.

Large Volume Handling

Independent of the level of passion and enthusiasm of humans, their physical capacities are, unfortunately, limited. At the same time, chatbots can quite effortlessly serve numerous banking customers simultaneously, delivering prompt responses without any risks to the quality or pace of work.

Linguistic Flexibility

A chatbot can communicate in many languages and dialects. Thus, the bank can attract an even greater number of customers, expanding the target audience thanks to the bot’s linguistic capacity.

Scalability

Chatbots for banking can be up- or down-scaled as required by financial institutions to enhance their reach, covering a wider population of customers.

Automation

Utilizing chatbots can assist in streamlining routine and laborious responsibilities traditionally carried out by human representatives. This would allow human agents to free up their time to focus on more complex inquiries and enhance personalized customer experiences. Studies indicate that over 85% of customer interactions in sectors like banking can be efficiently handled through automated chatbot conversations.

Data Collection and Analysis

Chatbot technology facilitates the capturing of various interactions with customers, which can be promptly analyzed to define the wants and needs of the target audience and identify emerging trends. Thus, AI banking chatbots facilitate the data-driven management of this business function.

Personalization

With access to customer-related information, chatbots can adjust their conversations and suggestions. This provides a relatively high level of personalization that customers do not experience in other customer service channels.

Efficient Security and Verification

Secure and advanced banking chatbots can ensure the safety of the customer’s financial details and their transactions. Technologies such as biometrics, QR codes and 3D facial recognition systems are commonly used to provide access to certain data banks. But when performing sensitive transactions, most chatbots go even further and use multi-level authentication systems to ensure the highest level of security.

Easy Integration

One of the things that may stop banking business owners from implementing chatbots is not knowing what to do with existing systems. The good news is that they do not need to be removed or replaced. Chatbots are quite easily integrated with banking infrastructures and various platforms that financial enterprises are accustomed to.

Up-selling and Cross-selling

The automated system can learn the customer needs and suggest the best possible financial products or services offered by the bank. Besides, the chatbots can prompt the customers to avail any service that might benefit them. In these ways, the use of bots can automatically initiate up-selling and cross-selling techniques.

Omnichannel Capabilities

The bots can interact with the customer in a personalized manner in various platforms like smartphones, desktop, website, & others. This method of interaction ensures omnichannel experiences to the modern generation banking customers.

Cost-Effectiveness

Introducing chatbot technology in the banking system is much cheaper than retraining the staff, hiring new workers and paying them salaries. The savings can be used to enhance the quality of the offered products and services.

24/7 Availability

Chatbots offer instant responses and are at your service around the clock, so customers will not feel cut off from access to the bank’s support when needing immediate answers outside of the bank’s business hours.

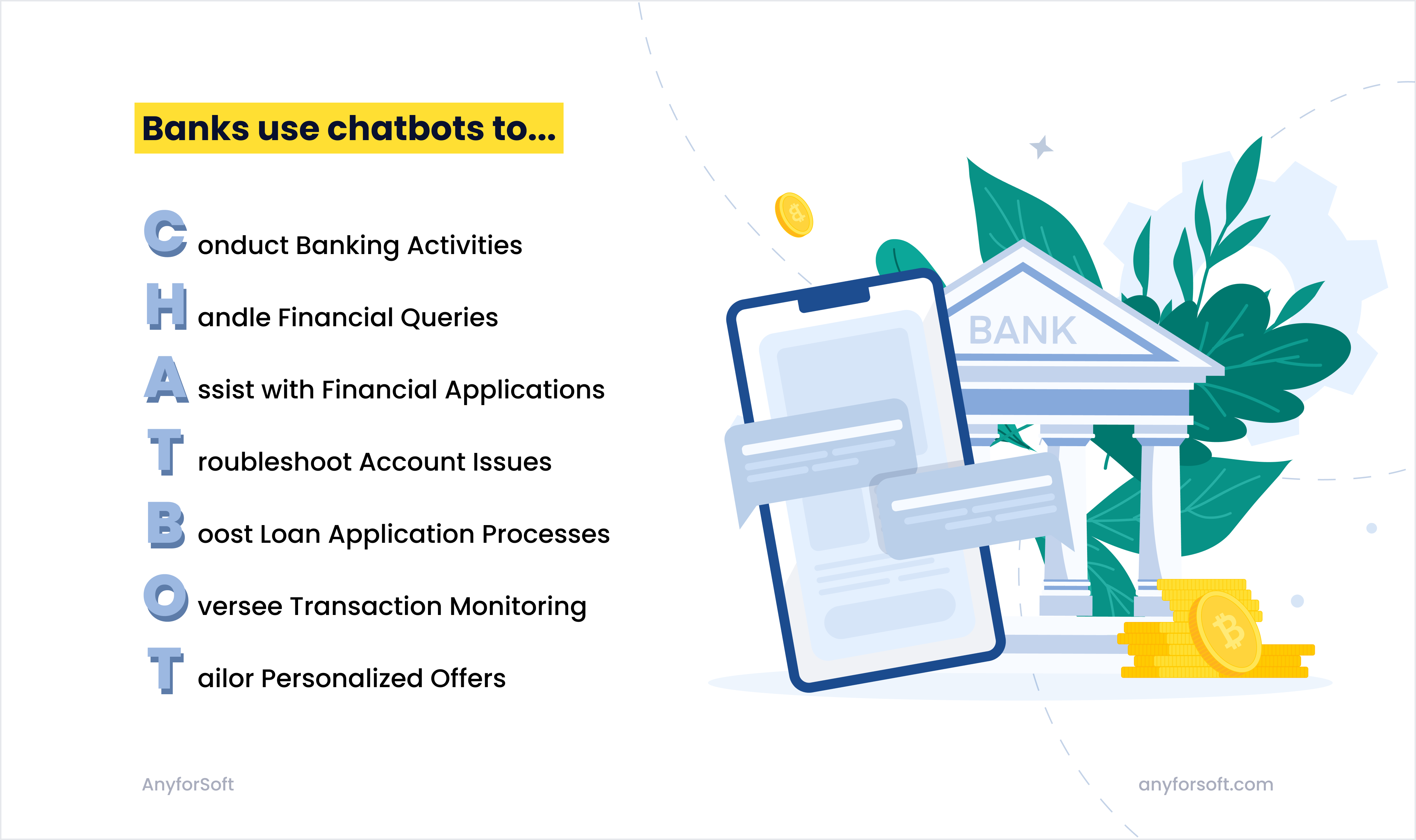

Chatbots Use Cases in Banking Industry

All these flattering epithets and benefits are all great, but how to use chatbots in banking scenarios? Let’s see the most common examples of these digital assistants in action.

Conduct Essential Banking Activities

With AI chatbots banking technology, customers no longer need to wait in long lines for basic services. Instead, they can instantly get reliable answers and assistance from banking chatbots. These AI-driven assistants automate essential banking tasks, such as transferring money between accounts and paying monthly bills, allowing customers to maximize the convenience of mobile banking.

Virtual Financial Advisors

Chatbots for banks can act like a virtual financial advisor, based on data provided by a certain user. For example, MyEva is a chatbot, in the role of the financial advisor, which may help achieve one’s financial aims such as saving or investing money more effectively. Apart from providing information about the account, bots can inform clients about various banking products and services for business or personal needs. Such bots can also recommend self-service options, warn when the spending limit is reached, remind of an upcoming date of the payment, and give some tips related to financial education.

Assisting Customers with Financial Product Applications

Individuals seeking financial products, such as mortgage loans, can start by interacting with a chatbot. For instance, a potential applicant might ask, “What is the process to get a mortgage?” or “Can you help me apply for a mortgage?” The chatbot will promptly guide them through a series of questions to collect essential details like their income, employment history, and the loan amount they are interested in. If the person asking is already a bank client, the bot can check the necessary data, such as credit history in the database, and give an answer based on the available information.

Bank Security Chatbots

Bank chatbots using machine learning can detect suspicious transactions and protect customers against fraud. For instance, in the case of an unusual transaction, such as a large purchase abroad, the chatbot can send an alert to the user’s device with text like: “An unusual transaction has been noticed on your credit card. Are you going to spend $5,000 in Las Vegas? 🙂” Next, the client will be offered an action, either to confirm the transaction or to deny it. Also, the client will be able to instantly block the account if it has been hacked. Example: Capital One’s ‘Eno’ secures user data, detects fraud for online shopping using virtual card numbers.

Prompt Alerts and Reminders

Bank’s chatbot services may include sending scheduled notifications and reminders. They may be related to various banking services and activities, such as paying bills, loan offers, and account updates. Alerts can be sent through mobile apps, different messaging platforms, or directly as a voice call. For example, in case a customer forgets to pay a bill, a bot will inform them about it a day before that, so the bill will be paid on time and no fees will not be charged. Or a bank has introduced a new service that a certain client may need—say, a favorable credit offer. The chatbot monitors the customer’s account who has been looking for some assistance in paying their bills on time and receives a special alert about the new product. Thus, banks can contribute to better customer experience and stronger relationships, since bank account users will be sure that they control their funds in the best possible way.

Leveraging Conversational AI for Advanced Customer Support

When dealing with complex inquiries like mortgage applications or loan approvals, customers often prefer human conversation. This is where the distinction between traditional chatbot vs conversational AI becomes crucial. While a chatbot for banking can handle basic tasks efficiently, conversational banking chatbots must seamlessly transfer complex issues to human support. The solution offers numerous benefits to financial institutions, which can offer both options to customers by using chatbots for live chat or asynchronous messaging. In the case of perplexing financial issues, the speed of response is seldom imperative, while a deep and thoughtful answer is almost always an advantage. By integrating human support with chatbot technology, banks provide a balanced approach, ensuring customer satisfaction and trust.

How Chatbots are Changing the Banking Sector

The digital transformation in finance is evident, and the advent of chatbots is a direct result. These AI-powered assistants are taking on many banking tasks traditionally handled by human customer service agents. What’s the outcome? Simply put: faster and more efficient 24/7 service.

An area that has been trialed with a great deal of success is online banking. Human staff can be allowed to attend to more complex issues, as chatbots are easily able to respond in pre-programmed routines and transactions. Which ultimately improves customer engagement and satisfaction level.

Exciting progress is also being made with voice bots. These chatbots respond to voice commands and they work on the basis of voice recognition technology. Customers can check balances, transfer money, or pay bills just by speaking. Customers can check balances, transfer money, or pay bills just by speaking.

AI chatbots in banking are becoming increasingly sophisticated with each passing day. They’re learning to understand context and nuance in customer queries. This results in more precise, informative answers. Bots are just one category in a larger wave of RPA in finance, optimizing resources and operational tasks.

Banks that use chatbots are seeing a real boost in efficiency. Bots can scale or carry out thousands of interactions at once. This quickens service and diminishes wait times.

The digital transformation in banking is well underway. And as chatbots continue to evolve, they’re not just changing how people bank – they’re reshaping the entire financial sector.

Enhance the Banking Experience with Anyforsoft

In today’s digital age, chatbot applications in banking are no longer a luxury but a necessity. At Anyforsoft we realize how revolutionary these AI-infused solutions are. Through chatbot applications, banks can offer continuous support with a personal touch. They are programmed to answer common questions and by doing so save important (otherwise wasted) time of the staff. With agile and efficient chatbot integration, which is one of the Anyforsoft fintech development services, your customers will get the hassle-free experience they truly deserve.

FAQs

Banking chatbots use AI to engage with customers. They can retrieve information from databases, answer people’s questions, and provide financial assistance. The self-service tools learn from past chats to get smarter over time. They aim to give quick help without needing a human banker.

Banking chatbots use AI to engage with customers. They can retrieve information from databases, answer people’s questions, and provide financial assistance. The self-service tools learn from past chats to get smarter over time. They aim to give quick help without needing a human banker.

Banking chatbots take security seriously. They use strong encryption to protect your info. Most only show general account details, not sensitive stuff. But nothing’s perfect, so it’s smart to be cautious with personal details. Always double-check before sharing anything private.

Banking chatbots take security seriously. They use strong encryption to protect your info. Most only show general account details, not sensitive stuff. But nothing’s perfect, so it’s smart to be cautious with personal details. Always double-check before sharing anything private.

AI banking chatbots can definitely help with money moves. They can set up transfers between accounts or to other people. Some can even pay bills for you. But for big or complex stuff, you might still need a human banker.

AI banking chatbots can definitely help with money moves. They can set up transfers between accounts or to other people. Some can even pay bills for you. But for big or complex stuff, you might still need a human banker.

AI is really good at catching bank fraud. It can scan tons of transactions super fast, finding odd patterns humans might miss. Machine learning helps it get smarter over time at finding new scams. But it’s not perfect, so banks still need human experts too. AI and humans work best as a team to keep your money safe.

AI is really good at catching bank fraud. It can scan tons of transactions super fast, finding odd patterns humans might miss. Machine learning helps it get smarter over time at finding new scams. But it’s not perfect, so banks still need human experts too. AI and humans work best as a team to keep your money safe.